The competition isn't playing around when it comes to silicon.

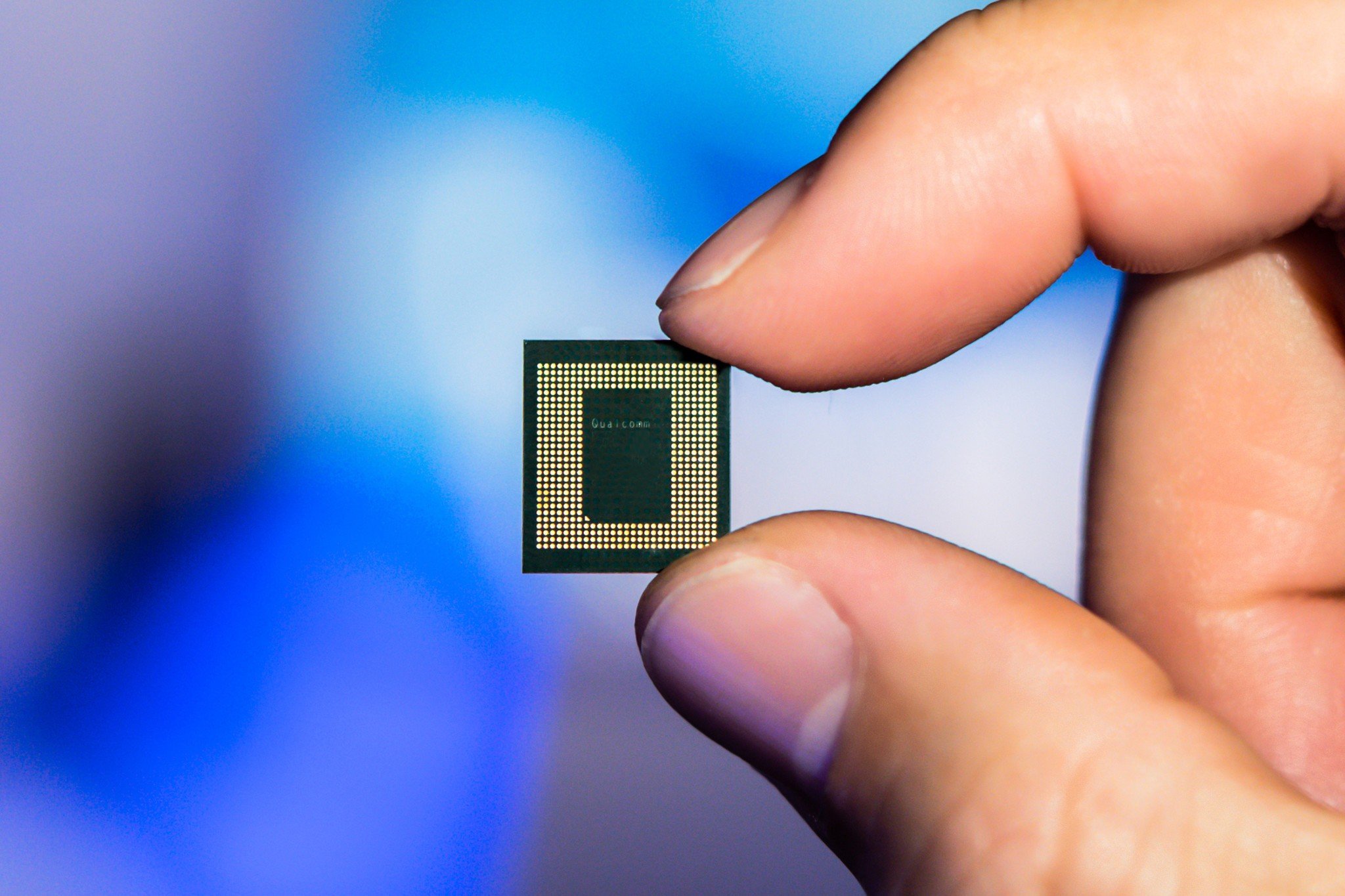

Apple has the M1 chip. Google's currently working on its own silicon endeavor. And then there's Microsoft, championing its Qualcomm-bound SQ1 and SQ2 processors seen in the Surface Pro X. Is it time for Microsoft to detach from Qualcomm and go solo like its tech industry brethren?

There's a chance Microsoft doesn't care about this particular race and would prefer to maintain its existing partnership, especially since Qualcomm recently said it'll be upping its game to try to keep up with Apple. But that's a lofty goal that'll take time to come to fruition. Until then, Microsoft's stuck with what Qualcomm's offering.

With these items in mind, a question is born: What's the optimal silicon strategy for Microsoft, given its current situation? Windows Central spoke to industry analysts to learn more.

Microsoft silicon: Is there a benefit to it?

Speaking about whether there were any benefits to Microsoft producing its own silicon, John Lorenz, a senior analyst of the computing technology and market category at Yole Développement, shared some thoughts. He pointed out that the scope of the task has different implications for Apple than it does for Microsoft. "The Windows OS needs to work on devices from dozens of other OEMs, while Apple just has to worry about Apple," he said.

Furthermore, Lorenz highlighted that Apple has a history with this sector on an organizational level, thanks to its iPad and iPhone efforts. "That kind of organizational experience is a deep foundation that would be hard to replicate with any shortcuts," he explained, adding that though some overall benefit is possible, the obstacles Microsoft would face in its road to silicon are numerous.

Anshel Sag, a senior analyst at Moor Insights & Strategy, gave insights on the matter as well. "The benefit would really only make sense if Microsoft had built out enough ARM-specific optimizations for Windows that would make it beneficial to Microsoft building its own processors," he stated. "That's effectively why Apple does it and why Google did it."

"You do get more control over your hardware and your software and the tuning between the two," said Shane Rau, a research vice president of the computing semiconductors team at IDC. "For example, in the case of Apple, by having the M1, they can tune it to work with macOS. So conceivably, Microsoft could benefit in the same way. It does take a lot of upfront costs, but once in place, you do have control over your own destiny."

Microsoft silicon: What can be done right now?

Given that chasing silicon may not be the optimal route and that no matter what happens, a waiting period will be involved, we asked the experts what Microsoft could do in the meantime to stay competitive.

Lorenz posited that Windows 11 would play a part in immediate improvements. "Windows 11 is bringing improvements to the way Windows on ARM handles compiling and emulations, which will open more doors for Windows on highly mobile form factors," he said. He's not counting out a Qualcomm solution just yet, though. Given the company's Nuvia acquisition and anticipated 2022 slate, he argued it could bounce back into the competitive limelight and change the conversation.

Sag's view was also related to how Windows and ARM currently play with each other. "Microsoft should be investing more resources into making Windows more ARM friendly, more than it already has," Sag said. "Microsoft needs the power of the entire ARM ecosystem and its silicon vendors if it wants to fight Apple on the M1 front. This, of course, puts even more strain on the Wintel (Windows + Intel) unspoken alliance."

Rau theorized that Microsoft's existing relationship with Qualcomm might be the answer that's hiding in plain sight, given that Microsoft can tune itself around Qualcomm as the latter works on staying competitive.

Microsoft silicon: The Windows 11 element

All three experts agreed that Windows 11 has the potential to change the game in the sense that it'll ideally produce more efficient software that's better suited for less powerful ARM silicon.

However, that's all there is right now: Potential. Lorenz argued for a wait-and-see approach to the topic. Similarly, Sag didn't feel Windows 11 was a guarantee of a brighter future. "I have yet to see anything concrete from Microsoft that indicates that the company intends to push full force forward as Apple has," he said.

Microsoft silicon: Alternative solutions

There is the question of whether Microsoft is better off looking for an alternative to Qualcomm in the long run, and if so, where. All three experts agreed that one shouldn't count Qualcomm out, though they had thoughts about hypothetical alternatives.

"The reported collaboration between Samsung and AMD is looking interesting, where an Exynos processor would integrate AMD graphics," Lorenz said. "It seems like this will first appear as a phone processor, but it is not too speculative to think a laptop version is on the horizon."

Sag argued that there aren't better alternatives to Qualcomm in the PC sector as the market stands right now. However, he also felt that Qualcomm was not the sole name worth discussing when it came to Windows on ARM. "There is going to be room for others down-market for more affordable devices like MediaTek," he stated.

Likewise, Rau namedropped MediaTek when addressing the existing pool of ARM-based alternatives Microsoft can turn to long term. "I think one can look within the existing ARM ecosystem for candidates," he said. "Possibly maybe MediaTek. MediaTek produces processors that run on Chromebooks. If Windows on ARM can also run on a MediaTek-based ARM system, then conceivably that can be part of a long-term strategy to maintain a healthy Windows on ARM ecosystem."

With that said, Rau highlighted that he thinks Qualcomm will be in the game for a long time. Sag and Lorenz also saw Qualcomm as relevant to the conversation for the foreseeable future. As such, don't go expecting a shakeup in the silicon scene yet — Microsoft may not be intent on going all-in like its rivals, so maintaining the status quo could very well be the strategy for the future, so long as Qualcomm sticks to its commitments and gets into fighting shape.

No comments: